Across three batches, the Curve Finance exploiter returned a total of 4,820 alETH worth $8.5 million back to the protocol.

Across three separate transaction batches, the Curve Finance exploiter returned a total of 4,820 alETH worth $8.5 million back to the protocol.Connect/Create WalletNo wallet? No problem. You can set one up for free. We recommend Torus for first-time users.The Curve Finance exploiter appears to be returning funds back to the protocol, according to on-chain data.

The hacker returned a total of 4,820 alETH to Alchemix Finance. The first transaction appeared to be a test of 1 alETH, with a batch of 1,000 alETH worth $1.7 million following around 9:00 a.m. ET. Another 3,819 alETH worth $6.7 million came a few minutes later, on-chain data shows. The wallet associated with the Curve Finance exploiter returned funds in three batches. Photo: EtherscanAlchemix Finance is a loan-based DeFi protocol that uses Curve pools. The price of one alETH, or Alchemix ETH, is currently around $1,755, according to the cryptocurrency price tracker CoinGecko.the hacker to return the funds on Aug. 3. The hacker responded, requesting Curve confirm the address of 0xbabe.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Curve DAO (CRV) up 7%, Is Curve Out of the Woods?.CurveFinance printed mild surge as attempt to return to normalcy intensifies

Curve DAO (CRV) up 7%, Is Curve Out of the Woods?.CurveFinance printed mild surge as attempt to return to normalcy intensifies

Read more »

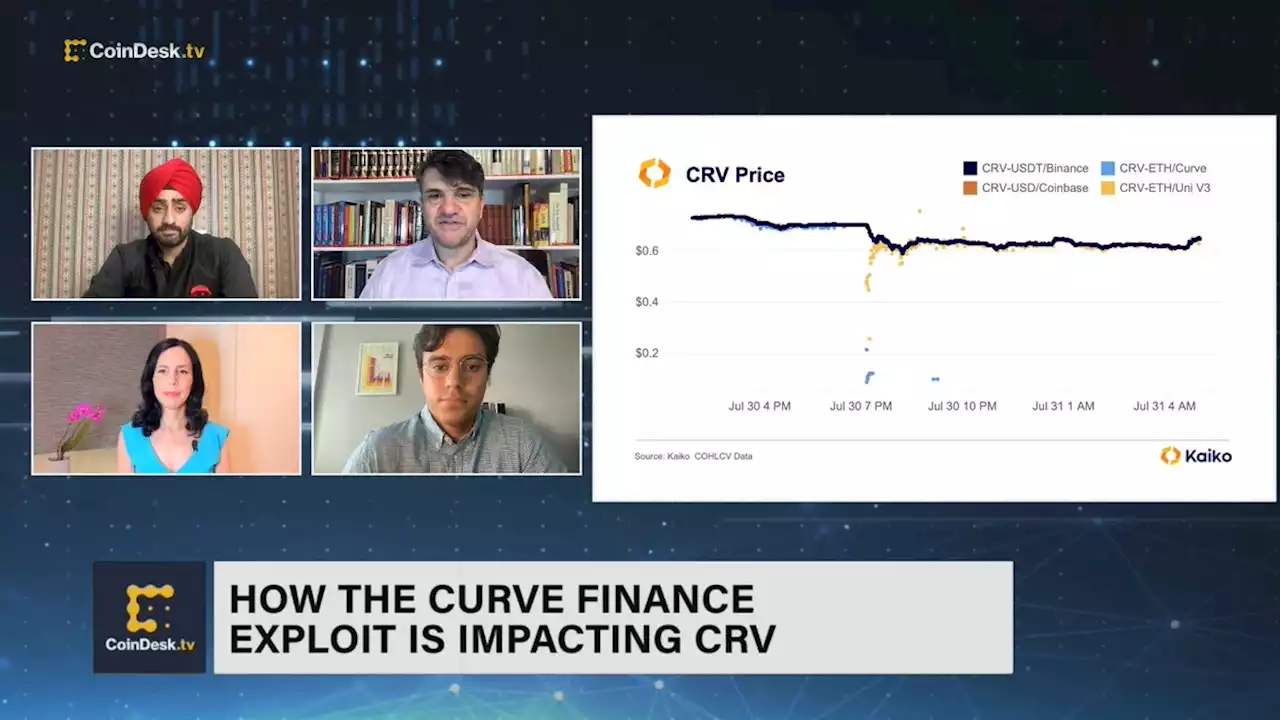

Curve Finance Token Falls 20% in Past Week After Major ExploitCurve Finance's native token CRV has declined roughly 20% in the past week. This comes as Kaiko releases new research since the DeFi exploit that put more than $100 million worth of crypto at risk. Kaiko research analyst Riyad Carey discusses the latest report.

Curve Finance Token Falls 20% in Past Week After Major ExploitCurve Finance's native token CRV has declined roughly 20% in the past week. This comes as Kaiko releases new research since the DeFi exploit that put more than $100 million worth of crypto at risk. Kaiko research analyst Riyad Carey discusses the latest report.

Read more »

Justin Sun, DWF Labs, DCF God and Others Buys CRV Token From Curve Founder | CoinMarketCapCryptoNews: The founder of CurveFinance, Michael Egorov, received assistance from a number of DeFi figures when his DeFi loan positions were at risk following an attack on decentralized exchange Curve. 🧐

Justin Sun, DWF Labs, DCF God and Others Buys CRV Token From Curve Founder | CoinMarketCapCryptoNews: The founder of CurveFinance, Michael Egorov, received assistance from a number of DeFi figures when his DeFi loan positions were at risk following an attack on decentralized exchange Curve. 🧐

Read more »

Curve emergency DAO terminates rewards for hack-related poolsBoth Curve and Multichain were exploited in July, but some related pools had still been paying out governance token rewards.

Curve emergency DAO terminates rewards for hack-related poolsBoth Curve and Multichain were exploited in July, but some related pools had still been paying out governance token rewards.

Read more »

Huobi’s Jun Du acquires 10 million CRV tokens to support CurveHuobi co-founder Jun Du purchased 10 million CRV tokens for $4 million from Curve’s founder, Michael Egorov, as he seeks to reduce his loan exposure.

Huobi’s Jun Du acquires 10 million CRV tokens to support CurveHuobi co-founder Jun Du purchased 10 million CRV tokens for $4 million from Curve’s founder, Michael Egorov, as he seeks to reduce his loan exposure.

Read more »

Aave Chan founder proposes buying $2M CRV from Curve founderMichael Egorov, the Curve founder, has total outstanding loans of over $100 million from various lending protocols. Out of this $70 million loan in USDT is on Aave v2, using CRV as collateral.

Aave Chan founder proposes buying $2M CRV from Curve founderMichael Egorov, the Curve founder, has total outstanding loans of over $100 million from various lending protocols. Out of this $70 million loan in USDT is on Aave v2, using CRV as collateral.

Read more »