Citigroup Inc's first-quarter profit beat Wall Street expectations as it earned more from borrowers paying higher interest on loans.

Citi's deposits were roughly flat at $1.33 trillion from a quarter as well as a year ago as investors

into money market funds to chase greater yields. But Mason said the bank saw a pickup in deposits in March mainly from companies."The banking crisis may take attention from the efforts for a short period of time, but in the long run, this crisis will show where Citigroup's strengths lie by acting as a major stress test and will assist in simplifying operations in the long run," said Mona Dajani, a partner at New York-based law firm Shearman & Sterling LLP.

Thomas Hayes, chairman and managing member at Great Hill Capital, said Citi reported the weakest growth of the three major banks that reported results on Friday, but still exceeded expectations and managed to buy back $1 billion of stock.The bank's investment in services to corporations resulted in 31% growth in revenues in treasury and trade solutions.

Citi also got a windfall from asset sales, with revenue from legacy franchises unit rising 48% to $2.9 billion as the bank gained with the sale of the Indian consumer business to Axis.Mason expressed cautious optimism about a recovery in investment banking. The revenue in the division sank 25% from a year ago, weighed down by theStill, the bank saw a pickup in investment grade debt issuance in the first quarter and expects investment banking activity to recover in the latter part of the year.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

JPMorgan beats Wall Street estimates on boost from rate hikesJPMorgan Chase & Co's first-quarter profit beat Wall Street estimates as higher interest income offset weakness in dealmaking, and the biggest U.S. lender remained resilient through the banking crisis in March.

JPMorgan beats Wall Street estimates on boost from rate hikesJPMorgan Chase & Co's first-quarter profit beat Wall Street estimates as higher interest income offset weakness in dealmaking, and the biggest U.S. lender remained resilient through the banking crisis in March.

Read more »

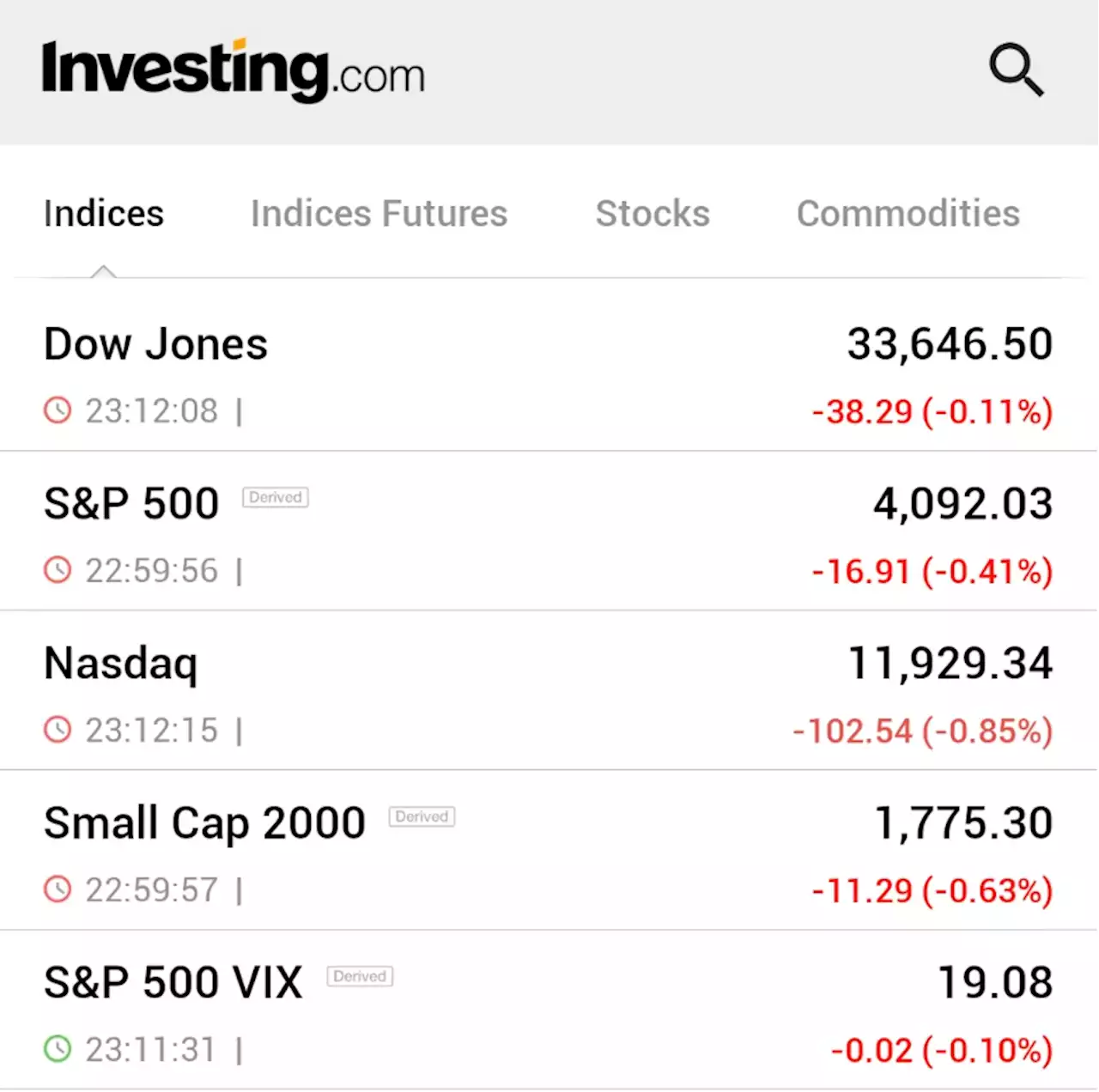

Wall Street closes lower after Fed minutes, inflation data By Reuters⚠️BREAKING: *WALL STREET CLOSES LOWER AFTER FED MINUTES, INFLATION DATA $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Wall Street closes lower after Fed minutes, inflation data By Reuters⚠️BREAKING: *WALL STREET CLOSES LOWER AFTER FED MINUTES, INFLATION DATA $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Read more »

Wall Street Shrugs Off Max As WBD Shares Dip 6%Shares of Warner Bros. Discovery dipped nearly 6% today as the company took the wraps off its rebranded streaming service amid a flood of new programming announcements. The venue was the Warner Bro…

Wall Street Shrugs Off Max As WBD Shares Dip 6%Shares of Warner Bros. Discovery dipped nearly 6% today as the company took the wraps off its rebranded streaming service amid a flood of new programming announcements. The venue was the Warner Bro…

Read more »

Wall Street closes lower after Fed minutes, inflation dataU.S. stocks ended lower on Wednesday after minutes from the Federal Reserve's March policy meeting revealed concern among several members of the Federal Open Markets Committee (FOMC) regarding the regional bank liquidity crisis.

Wall Street closes lower after Fed minutes, inflation dataU.S. stocks ended lower on Wednesday after minutes from the Federal Reserve's March policy meeting revealed concern among several members of the Federal Open Markets Committee (FOMC) regarding the regional bank liquidity crisis.

Read more »

Kremlin Denies Putin Personally Approved Wall Street Journal Reporter’s ArrestAn official separately stated that Russia might be open to a prisoner swap deal with the U.S.

Kremlin Denies Putin Personally Approved Wall Street Journal Reporter’s ArrestAn official separately stated that Russia might be open to a prisoner swap deal with the U.S.

Read more »