Britain’s leaking water industry is facing a tidal wave of problems. Financial troubles at Thames Water have thrown the spotlight on Britain’s privately held utilities. But much higher investment needs likely in the coming years will mean bigger bills and greater political scrutiny. That could make it hard to maintain ownership models in their current form.

are now valued close to their RCVs, as per Jefferies analysis, implying that shareholders don’t expect returns to get much more generous. In the past, companies have been valued as highly as 1.3 times their RCVs.

Yet even if the regulatory web is tighter, the UK would still look an outlier in allowing private water utilities in the first place. The very existence of return-seeking shareholders loads extra costs onto consumers and creates moral hazard, since owners may be tempted to do what they did before: borrow too much and skip investment. Even within the UK there are other models: the Scottish government owns its own water company.

Putting companies back into public or not-for-profit status wouldn’t automatically mean a much better deal for consumers. Average UK water bills arein the current year, versus 409 pounds in Scotland. Barclays analysts reckon this is lower than in both Germany and the United States. The amount of water lost to leakage has fallen to around 20% since privatisation, from 30%, and is lower than in Scotland as well as other countries likeYet the industry will soon face a much bigger test.

That extra cost will likely lead UK taxpayers and politicians to question the private model. One option would be to squeeze water companies – cutting allowed prices, and imposing bigger penalties on those that allow leaks. Yet if regulators are too tough companies will struggle to raise fresh equity, which may well be needed to fund the extra costs.

An alternative would be to ditch the private model, either by nationalising companies or by forcibly converting them into not-for-profit entities like Dwr Cymru, which is only funded with debt. That would save money. Each customer bill comprises a portion to deliver adequate returns to equity holders’ capital. For the sector as a whole, Ofwat assumes equity comprises 45% of water companies’ 94 billion pound RCV, or 42 billion pounds. Assuming a 6.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Breakingviews - Europe's biggest IPO prudently tests the waterEurope’s biggest listing this year is off to a cautious start. Hidroelectrica, Romania’s top hydropower producer, priced on Wednesday its initial public offering (IPO) at 104 lei ($22.87 per share, the middle of a proposed range, raising 1.8 billion euros. That values the whole utility at 46.8 billion lei, or 9.4 billion euros. It also suggests the company would trade at 10.5 times its 2022 earnings per share, a multiple 30% lower than the 14.8 times Austrian peer Verbund is currently trading at.

Breakingviews - Europe's biggest IPO prudently tests the waterEurope’s biggest listing this year is off to a cautious start. Hidroelectrica, Romania’s top hydropower producer, priced on Wednesday its initial public offering (IPO) at 104 lei ($22.87 per share, the middle of a proposed range, raising 1.8 billion euros. That values the whole utility at 46.8 billion lei, or 9.4 billion euros. It also suggests the company would trade at 10.5 times its 2022 earnings per share, a multiple 30% lower than the 14.8 times Austrian peer Verbund is currently trading at.

Read more »

Breakingviews - El Nino will brew up potent new economic stormJust when you thought it was safe to hope interest rates might soon peak, along comes more bad news. It looks likely that the El Nino weather phenomenon has returned, according to both the U.S. National Oceanographic and Atmospheric Administration and the Australian Bureau of Meteorology. Its appearance usually results in, or exacerbates, floods, heatwaves, water scarcity and wildfires, especially in the southern hemisphere. The damage these inflict on crops and infrastructure is inflationary, putting pressure on central banks to tighten monetary policy. If climate change makes such events stronger and more frequent, supply shocks will become embedded.

Breakingviews - El Nino will brew up potent new economic stormJust when you thought it was safe to hope interest rates might soon peak, along comes more bad news. It looks likely that the El Nino weather phenomenon has returned, according to both the U.S. National Oceanographic and Atmospheric Administration and the Australian Bureau of Meteorology. Its appearance usually results in, or exacerbates, floods, heatwaves, water scarcity and wildfires, especially in the southern hemisphere. The damage these inflict on crops and infrastructure is inflationary, putting pressure on central banks to tighten monetary policy. If climate change makes such events stronger and more frequent, supply shocks will become embedded.

Read more »

![]() Breakingviews - Ghost of Silicon Valley Bank turns up in ItalyA crisis at a small Italian insurer has rekindled concerns about the effect of rising rates. The rapid collapse of Silicon Valley Bank earlier this year was largely down to an ill-advised bond portfolio and liabilities that were less sticky than assumed. While Italy’s Eurovita isn’t a bank, its demise has some similarities with events across the Atlantic.

Breakingviews - Ghost of Silicon Valley Bank turns up in ItalyA crisis at a small Italian insurer has rekindled concerns about the effect of rising rates. The rapid collapse of Silicon Valley Bank earlier this year was largely down to an ill-advised bond portfolio and liabilities that were less sticky than assumed. While Italy’s Eurovita isn’t a bank, its demise has some similarities with events across the Atlantic.

Read more »

Breakingviews - Why central banks cannot relax in inflation fight: podcastWestern policymakers have frantically hiked interest rates to dampen consumer prices. In this Exchange podcast, Claudio Borio, a top official at the Bank for International Settlements, argues that rate-setters need to keep going to ensure costs of living won’t stay elevated.

Breakingviews - Why central banks cannot relax in inflation fight: podcastWestern policymakers have frantically hiked interest rates to dampen consumer prices. In this Exchange podcast, Claudio Borio, a top official at the Bank for International Settlements, argues that rate-setters need to keep going to ensure costs of living won’t stay elevated.

Read more »

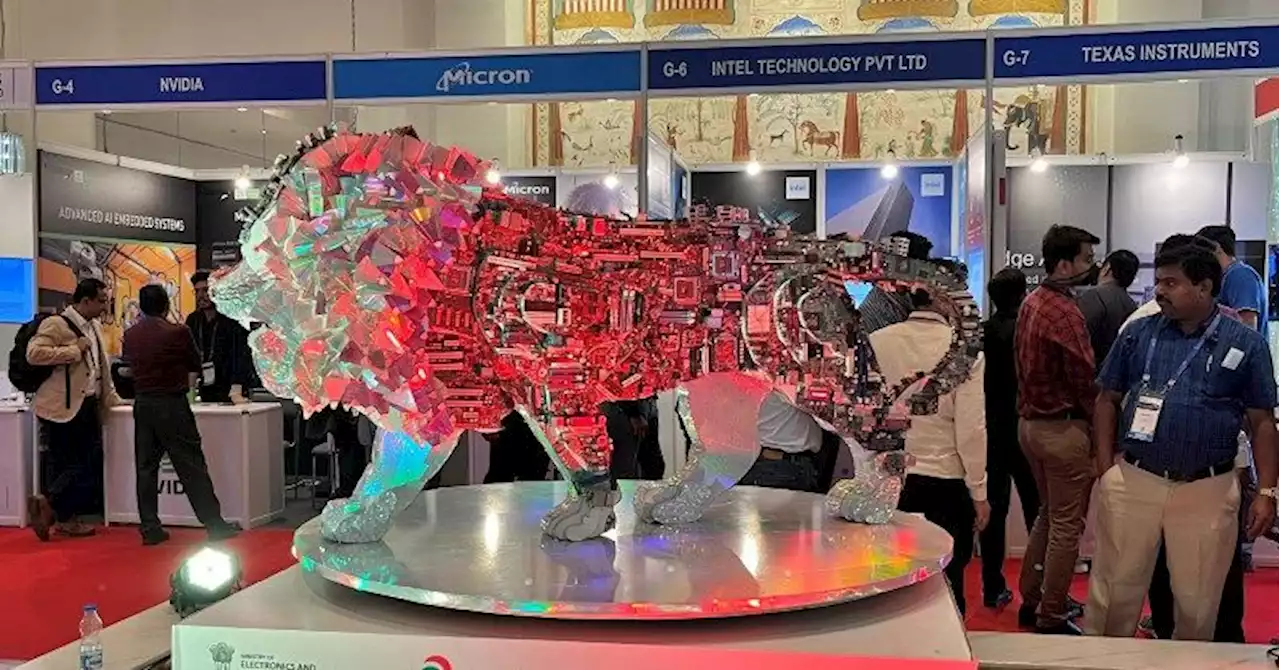

Breakingviews - India can aim lower in its chip dreamsIndia’s semiconductor dreams are facing a harsh reality. After struggling to woo cutting-edge chipmakers like Taiwan Semiconductor Manufacturing to set up operations in the country, the government may now have to settle for producing less-advanced chips instead. Yet that’s no mere consolation prize: the opportunity to grab share from China in this commoditised but vital part of the tech supply chain could pay off.

Breakingviews - India can aim lower in its chip dreamsIndia’s semiconductor dreams are facing a harsh reality. After struggling to woo cutting-edge chipmakers like Taiwan Semiconductor Manufacturing to set up operations in the country, the government may now have to settle for producing less-advanced chips instead. Yet that’s no mere consolation prize: the opportunity to grab share from China in this commoditised but vital part of the tech supply chain could pay off.

Read more »

Financial Experts Are Sharing 10 Money Red Flags To Look Out For In A Potential Partner“If someone you’re dating makes you feel ashamed or embarrassed about your own financial situation, that’s a red flag. This topic should be a no-shame zone when it comes to dating.”

Financial Experts Are Sharing 10 Money Red Flags To Look Out For In A Potential Partner“If someone you’re dating makes you feel ashamed or embarrassed about your own financial situation, that’s a red flag. This topic should be a no-shame zone when it comes to dating.”

Read more »