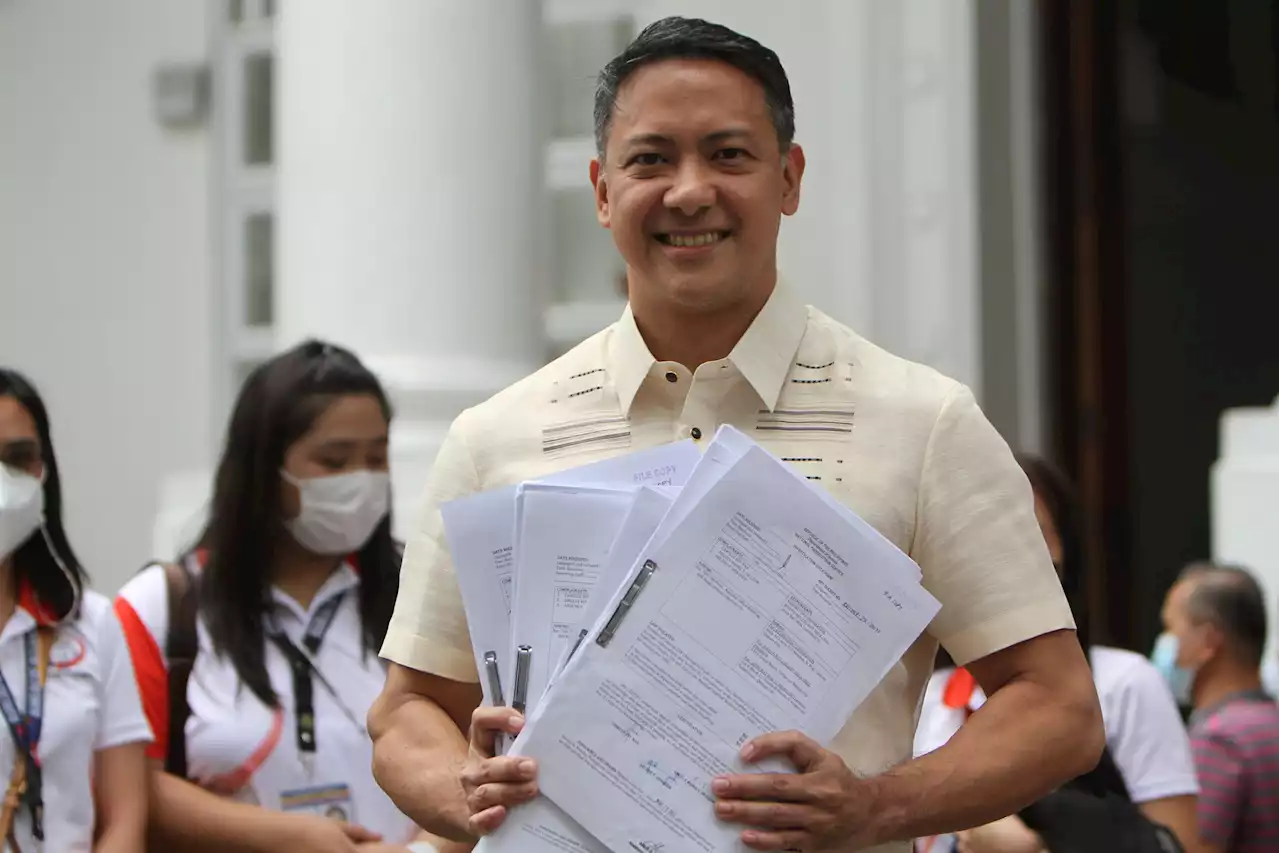

The Bureau of Internal Revenue filed criminal complaints at the Department of Justice against four “ghost corporations” selling fake receipts that deprived the national government of some P26 billion in revenues for the years 2019-2021. /PDI

They are facing complaints for alleged violation of Sections 254 , 255 , and 267 of the National Internal Revenue Code of 1997, also known as the Tax Code.

“This syndicate establishes a corporation. So if you look into it, the corporation is registered. They obtain receipts that are actually registered, but the transactions are fake,” he added. The BIR said that after the raid, an investigation showed that the ghost corporations were only established for the sole purpose of selling fictitious sales invoices and receipts to their buyers for the claim of false and anomalous purchases.

In 2022, BIR collections increased by 12.4 percent to P2.34 trillion from P2.08 trillion a year earlier. In November 2022, the BIR raided a warehouse in Manila where they found millions of pesos worth of illegal vape products.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

P25.5-B tax raps filed vs 4 corporations for issuing fake receipts to ‘ghost’ BIRA P25.5-billion worth of tax cases were filed before the Department of Justice against four ghost corporations encouraging clients to “ghost” the Bureau of Internal Revenue, causing government losses for the past three years. | T2TupasINQ

P25.5-B tax raps filed vs 4 corporations for issuing fake receipts to ‘ghost’ BIRA P25.5-billion worth of tax cases were filed before the Department of Justice against four ghost corporations encouraging clients to “ghost” the Bureau of Internal Revenue, causing government losses for the past three years. | T2TupasINQ

Read more »

Spending hike may offset income tax cuts–BIR | Jasper Y. ArcalasTHE Bureau of Internal Revenue (BIR) is banking on higher spending by Filipinos to offset the possible reduction in its collection of personal income tax as a result of the second round of income tax reduction under the TRAIN law. BIR Commissioner Romeo D. Lumagui Jr. said money collected by…

Spending hike may offset income tax cuts–BIR | Jasper Y. ArcalasTHE Bureau of Internal Revenue (BIR) is banking on higher spending by Filipinos to offset the possible reduction in its collection of personal income tax as a result of the second round of income tax reduction under the TRAIN law. BIR Commissioner Romeo D. Lumagui Jr. said money collected by…

Read more »

P25.5 billion ‘lost’: BIR files tax complaints vs firms selling fake receiptsThe criminal complaints filed by the Bureau of Internal Revenue stem from the selling of fake sales invoices to companies looking to evade taxes.

P25.5 billion ‘lost’: BIR files tax complaints vs firms selling fake receiptsThe criminal complaints filed by the Bureau of Internal Revenue stem from the selling of fake sales invoices to companies looking to evade taxes.

Read more »

BIR files complaint vs. ghost companies with P25B tax liabilityThe Bureau of Internal Revenue (BIR) on Thursday filed criminal complaints against four “ghost” corporations involved in fake transactions with legitimate businesses for the evasion of taxes which resulted in revenue loss of P 25.5 billion.

BIR files complaint vs. ghost companies with P25B tax liabilityThe Bureau of Internal Revenue (BIR) on Thursday filed criminal complaints against four “ghost” corporations involved in fake transactions with legitimate businesses for the evasion of taxes which resulted in revenue loss of P 25.5 billion.

Read more »

BIR reshuffles middle officials, reg’l execsThe Bureau of Internal Revenue (BIR) has conducted another revamp in a bid to further strengthen the tax collection and administration programs of its field offices nationwide. Eleven middle level …

BIR reshuffles middle officials, reg’l execsThe Bureau of Internal Revenue (BIR) has conducted another revamp in a bid to further strengthen the tax collection and administration programs of its field offices nationwide. Eleven middle level …

Read more »

NBI files parricide raps vs son who killed, placed inside storage box his own momThe NBI filed before the DOJ a complaint for parricide against the son who admitted to killing his own mother and disposing of her body by placing it in a plastic storage box and leaving it in a grassy lot in Bulacan. | T2TupasINQ

NBI files parricide raps vs son who killed, placed inside storage box his own momThe NBI filed before the DOJ a complaint for parricide against the son who admitted to killing his own mother and disposing of her body by placing it in a plastic storage box and leaving it in a grassy lot in Bulacan. | T2TupasINQ

Read more »