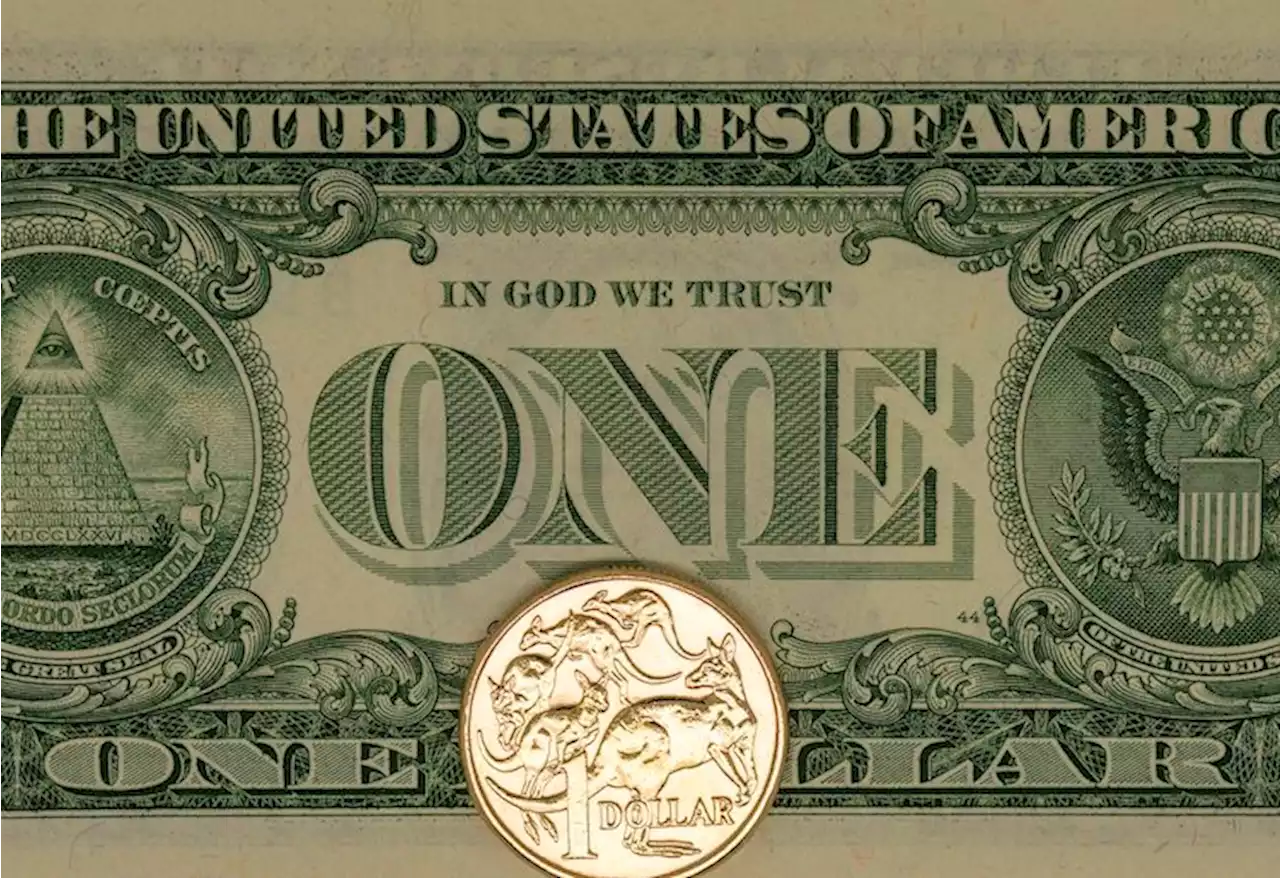

AUD/USD bears take a breather after refreshing the yearly low as oversold RSI joins the key Fibonacci ratio to mark an unimpressive effort to prod dow

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Market relief in Wall Street amid China’s jitters: Russell 2000, Straits Times Index, AUD/USDWall Street managed to start the week higher, tapping on some recovery in big tech and semiconductors to override earlier jitters around China’s property and financial sector risks.

Market relief in Wall Street amid China’s jitters: Russell 2000, Straits Times Index, AUD/USDWall Street managed to start the week higher, tapping on some recovery in big tech and semiconductors to override earlier jitters around China’s property and financial sector risks.

Read more »

Australian Dollar Fundamental Bias Breakdown: What Matters the Most for AUD/USD?The Australian Dollar is influenced by financial market sentiment, commodity prices and the RBA. But the influence of these variables is constantly evolving. This special report breaks it down.

Australian Dollar Fundamental Bias Breakdown: What Matters the Most for AUD/USD?The Australian Dollar is influenced by financial market sentiment, commodity prices and the RBA. But the influence of these variables is constantly evolving. This special report breaks it down.

Read more »

Australian Dollar Falls After Jobs Data Miss; How Much More Downside for AUD/USD?AUD/USD fell after the Australian economy created fewer-than-expected jobs last month. To what extent could AUD/USD fall and what are the key levels to watch?

Australian Dollar Falls After Jobs Data Miss; How Much More Downside for AUD/USD?AUD/USD fell after the Australian economy created fewer-than-expected jobs last month. To what extent could AUD/USD fall and what are the key levels to watch?

Read more »

AUD/USD Price Analysis: Renews YTD low as bears approach 0.6410 support with eyes on FOMC MinutesAUD/USD stands on slippery grounds near 0.6430 as it renews the Year-To-Date (YTD) low during the seven-day losing streak early Wednesday. In doing so

AUD/USD Price Analysis: Renews YTD low as bears approach 0.6410 support with eyes on FOMC MinutesAUD/USD stands on slippery grounds near 0.6430 as it renews the Year-To-Date (YTD) low during the seven-day losing streak early Wednesday. In doing so

Read more »

Comrade Elon: Musk's Tesla Slashes Prices in China Despite Promising to Uphold 'Core Socialist Values'In a desperate attempt to stay competitive in the Chinese market, Elon Musk's Tesla has announced a price cut of 14,000 yuan ($1,900) for its two higher-end Model Y vehicles. The price reduction is seen as the latest move in an ongoing price war that has been affecting the electric vehicle (EV) industry in China. Tesla previously promised to uphold the 'core socialist values' of communist China in an attempt to cool down the price war with local competitors.

Comrade Elon: Musk's Tesla Slashes Prices in China Despite Promising to Uphold 'Core Socialist Values'In a desperate attempt to stay competitive in the Chinese market, Elon Musk's Tesla has announced a price cut of 14,000 yuan ($1,900) for its two higher-end Model Y vehicles. The price reduction is seen as the latest move in an ongoing price war that has been affecting the electric vehicle (EV) industry in China. Tesla previously promised to uphold the 'core socialist values' of communist China in an attempt to cool down the price war with local competitors.

Read more »

AUD/USD slides below 0.6400 to refresh YTD low as downbeat Australia employment report joins hawkish Fed biasAUD/USD justifies downbeat Australia employment data, as well as the broad risk-off mood, by refreshing the Year-To-Date (YTD) low near 0.6370 during

AUD/USD slides below 0.6400 to refresh YTD low as downbeat Australia employment report joins hawkish Fed biasAUD/USD justifies downbeat Australia employment data, as well as the broad risk-off mood, by refreshing the Year-To-Date (YTD) low near 0.6370 during

Read more »