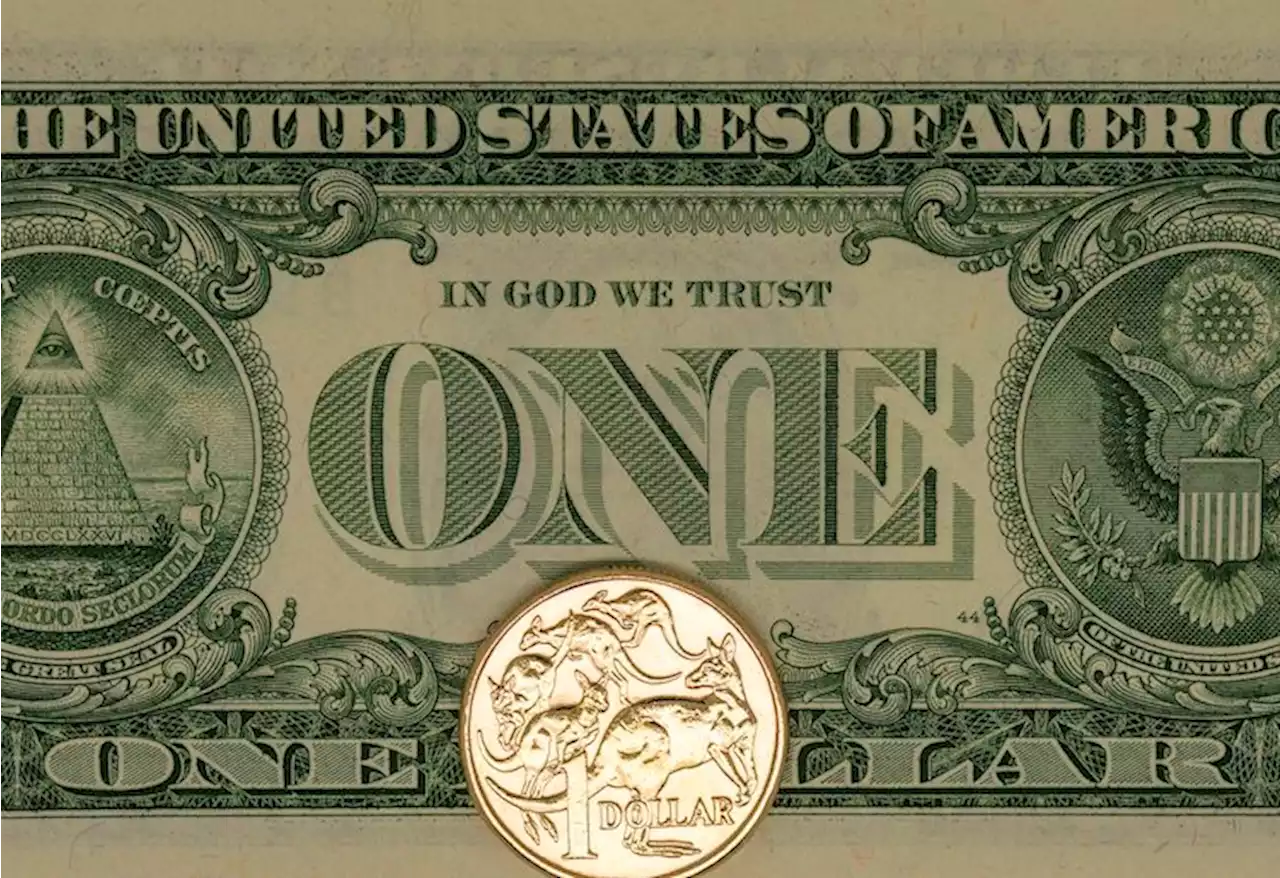

AUD/USD keeps the red below 0.6000 amid stronger USD, seems vulnerable near YTD low – by hareshmenghani AUDUSD Fed Recession RiskAversion Currencies

traday descent extends through the mid-European session and drags spot prices to the 0.6675-0.6670 area, or its lowest level since June 2020 touched on Friday.

A combination of factors assists the US dollar to regain positive traction on the first day of a new week, which, in turn, is seen exerting pressure on the AUD/USD pair. Firming expectations that the Fed will hike interest rates at a faster pace to tame inflation continues to act as a tailwind for the greenback. Apart from this, the prevalent risk-off environment offers additional support to the safe-haven buck and contributes to driving flows away from the risk-sensitive aussie.

The fundamental backdrop seems tilted firmly in favour of bearish traders and supports prospects for a further near-term depreciating move for the AUD/USD pair. Investors, however, might refrain from placing aggressive bets and prefer to move to the sidelines ahead of the two-day FOMC policy meeting, starting on Tuesday. The US central bank is scheduled to announce its decision on Wednesday and is universally expected to deliver at least a 75 bps interest rate increase.

The markets have also been pricing in a small chance of full 100 bps lift-off. Hence, the focus will be on the so-called dot-plot, which along with updated economic projections and Fed Chair Jerome Powell's remarks at the post-meeting press conference, might provide fresh clues about the US central bank's policy outlook.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold Price Forecast: XAU/USD hangs near YTD low, just above $1,660 amid stronger USDGold struggles to capitalize on Friday's goodish rebound from its lowest level since April 2020 and meets with a fresh supply on the first day of a ne

Gold Price Forecast: XAU/USD hangs near YTD low, just above $1,660 amid stronger USDGold struggles to capitalize on Friday's goodish rebound from its lowest level since April 2020 and meets with a fresh supply on the first day of a ne

Read more »

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, AUD/USD, USD/JPGet the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of September 18th, 2022 here.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, AUD/USD, USD/JPGet the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of September 18th, 2022 here.

Read more »

AUD/USD stays mildly offered near 0.6700 amid hawkish Fed bets, China concernsAUD/USD retreats towards the 28-month low marked the previous day, holding lower ground near the 0.6700 threshold ahead of Monday’s European session.

AUD/USD stays mildly offered near 0.6700 amid hawkish Fed bets, China concernsAUD/USD retreats towards the 28-month low marked the previous day, holding lower ground near the 0.6700 threshold ahead of Monday’s European session.

Read more »

USD/CAD retakes 1.3300, highest since November 2020 amid bearish oil/stronger USDUSD/CAD retakes 1.3300, highest since November 2020 amid bearish oil/stronger USD – by hareshmenghani USDCAD Recession Fed RiskAversion Currencies

USD/CAD retakes 1.3300, highest since November 2020 amid bearish oil/stronger USDUSD/CAD retakes 1.3300, highest since November 2020 amid bearish oil/stronger USD – by hareshmenghani USDCAD Recession Fed RiskAversion Currencies

Read more »

AUD/USD Price Analysis: Retreats towards two-month-old support near 0.6700 on PBOC actionAUD/USD Price Analysis: Retreats towards two-month-old support near 0.6700 on PBOC action – by anilpanchal7 AUDUSD PBOC Technical Analysis SwingTrading ChartPatterns

AUD/USD Price Analysis: Retreats towards two-month-old support near 0.6700 on PBOC actionAUD/USD Price Analysis: Retreats towards two-month-old support near 0.6700 on PBOC action – by anilpanchal7 AUDUSD PBOC Technical Analysis SwingTrading ChartPatterns

Read more »