AUD/USD: Further downside likely below 0.6630 – UOB – by pabspiovano AUDUSD Currencies Majors Banks

In the view of UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia, further retracement in24-hour view: “We indicated last Friday that ‘downward pressure has eased somewhat but AUD could drop towards the 0.6600 level again before a more sustained recovery is likely’. However, after dropping to 0.6618, AUD rebounded to a high of 0.6675 and then closed at 0.6651 . Downward pressure has eased and AUD has likely entered a consolidation phase.

Next 1-3 weeks: “In our latest narrative from last Friday , we noted that ‘downward momentum has not improved much’ but we see a chance for AUD to drop to 0.6575. AUD dropped to 0.6618, rebounded and then closed at 0.6651 . Short-term downward momentum is beginning to ease and AUD has to break and stay below 0.6630 in the next 1-2 days or the chance of it declining further to 0.6575 will fizzle out. Conversely, a clear breach of 0.6685 would indicate that AUD is not weakening further.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AUD/USD Price Analysis: Aussie bulls brace for bumpy ride below 0.6685-90 key hurdleAUD/USD Price Analysis: Aussie bulls brace for bumpy ride below 0.6685-90 key hurdle AUDUSD Technical Analysis SwingTrading ChartPatterns SupportResistance

AUD/USD Price Analysis: Aussie bulls brace for bumpy ride below 0.6685-90 key hurdleAUD/USD Price Analysis: Aussie bulls brace for bumpy ride below 0.6685-90 key hurdle AUDUSD Technical Analysis SwingTrading ChartPatterns SupportResistance

Read more »

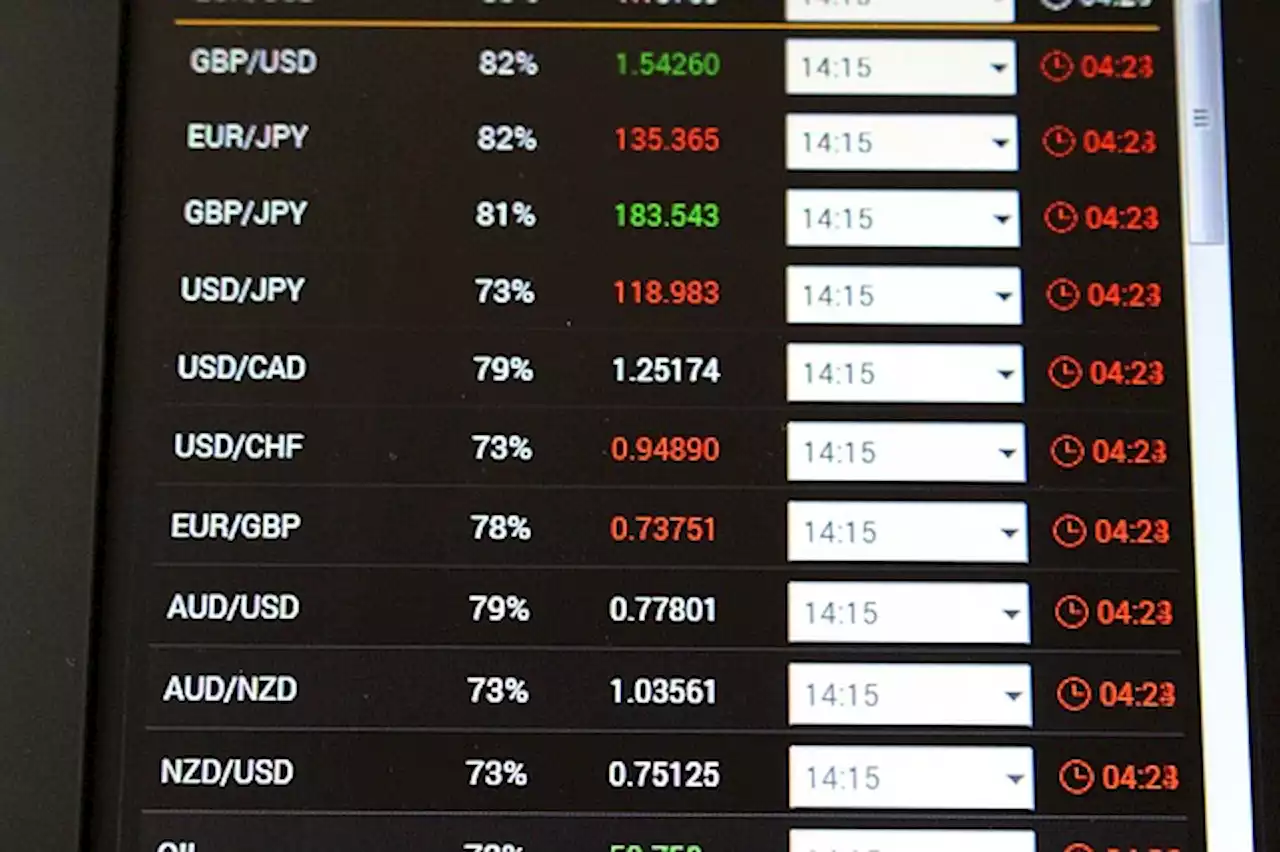

Pairs in Focus This Week \u2013 AUD/USD, USD/JPY, GBP/USDGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of May 21th, 2022 here.

Pairs in Focus This Week \u2013 AUD/USD, USD/JPY, GBP/USDGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of May 21th, 2022 here.

Read more »

GBP/USD: Downside alleviated above 1.2500 – UOBA breakout of 1.2500 should mitigate the downside pressure in GBP/USD, suggest UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist

GBP/USD: Downside alleviated above 1.2500 – UOBA breakout of 1.2500 should mitigate the downside pressure in GBP/USD, suggest UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist

Read more »

This lifetime learning bundle ft. Rosetta Stone is now price-dropped even furtherGet unlimited access to this lifetime learning subscription bundle featuring Rosetta Stone, one of the top language-learning apps.

This lifetime learning bundle ft. Rosetta Stone is now price-dropped even furtherGet unlimited access to this lifetime learning subscription bundle featuring Rosetta Stone, one of the top language-learning apps.

Read more »

As debt default looms closer, negotiators say they are moving further apartBoth sides are suggesting the other might just want the nation to default on its debt.

As debt default looms closer, negotiators say they are moving further apartBoth sides are suggesting the other might just want the nation to default on its debt.

Read more »

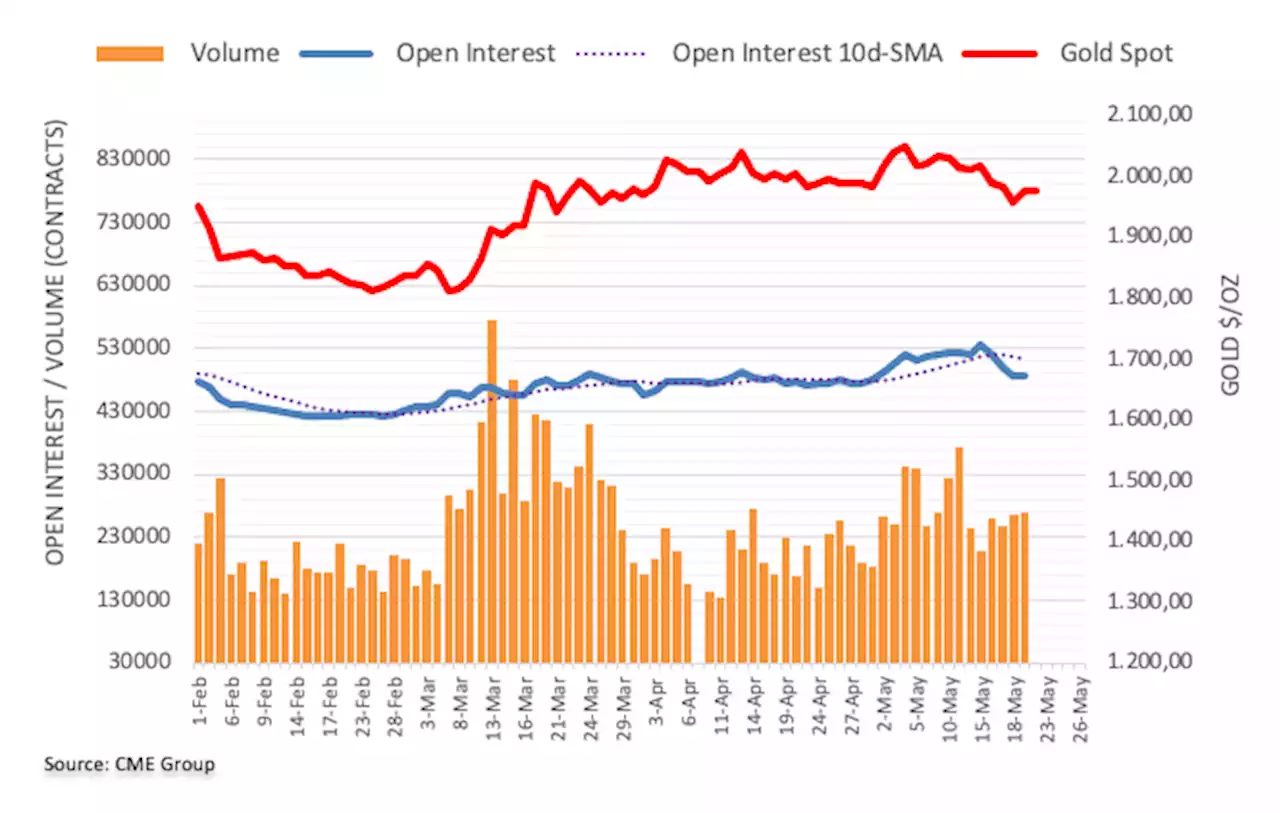

Gold Futures: Further recovery appears unlikelyOpen interest in gold futures markets extended the downtrend on Friday, this time by more than 1K contracts according to preliminary readings from CME

Gold Futures: Further recovery appears unlikelyOpen interest in gold futures markets extended the downtrend on Friday, this time by more than 1K contracts according to preliminary readings from CME

Read more »