AUD/USD falls from recent highs on risk-off impulse due to Fed tightening estimates – by christianborjon AUDUSD Majors Currencies

Fed) can continue to tighten monetary conditions. Hence, US Treasury bond yields remain climbing. The AUD/USD is trading at 0.6717 after hitting a high of 0.6741.The US Dollar is underpinned by elevated US T-bond yields. Compared to Tuesday’s close, the US 2-year Treasury note is yielding 4.265%, gains six and a half basis points. For the upcoming May meeting, traders expect a 25 bps rate hike, as theshows, with odds at 82.8%.

Regarding monetary policy, Bostic favors one more hike and a pause, while Bullard expects an additional 50 bps of tightening to lift rates to the 5.50%-5.75% range.On the Australian front, a lightkept AUD/USD traders leaning on recent data. The latest growth report about China’s economy maintained the Australian Dollar from falling further against the US Dollar.

were held steady at 3.60%. Notably, the minutes indicated concerns about high inflation and a tight labor market, leaving the possibility of further tightening on the table.Even though the AUD/USD fall was capped at the 20-day EMA at 0.6706, the pair remains neutral to downward biased. For a bullish resumption, the AUD/USD must break the 50-day EMA at 0.6734, which will pave the way toward the 100-day EMA at 0.6756. Break above, and the 0.6800 psychological level would be up for grabs.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AUD/USD defies hawkish Fed officials, surges on soft USD and falling bond yieldsAUD/USD caps its two-day downtrend at around the 20-day EMA and climbs toward the 50-day EMA, bolstered by a soft US Dollar (USD), which is undermined

AUD/USD defies hawkish Fed officials, surges on soft USD and falling bond yieldsAUD/USD caps its two-day downtrend at around the 20-day EMA and climbs toward the 50-day EMA, bolstered by a soft US Dollar (USD), which is undermined

Read more »

AUD/USD: Mildly bid below 0.6750 on mixed concerns about Fed, ChinaAUD/USD picks up bids to print mild gains around 0.6730 heading into Wednesday’s European session. Even so, the Aussie pair struggles to extend the pr

AUD/USD: Mildly bid below 0.6750 on mixed concerns about Fed, ChinaAUD/USD picks up bids to print mild gains around 0.6730 heading into Wednesday’s European session. Even so, the Aussie pair struggles to extend the pr

Read more »

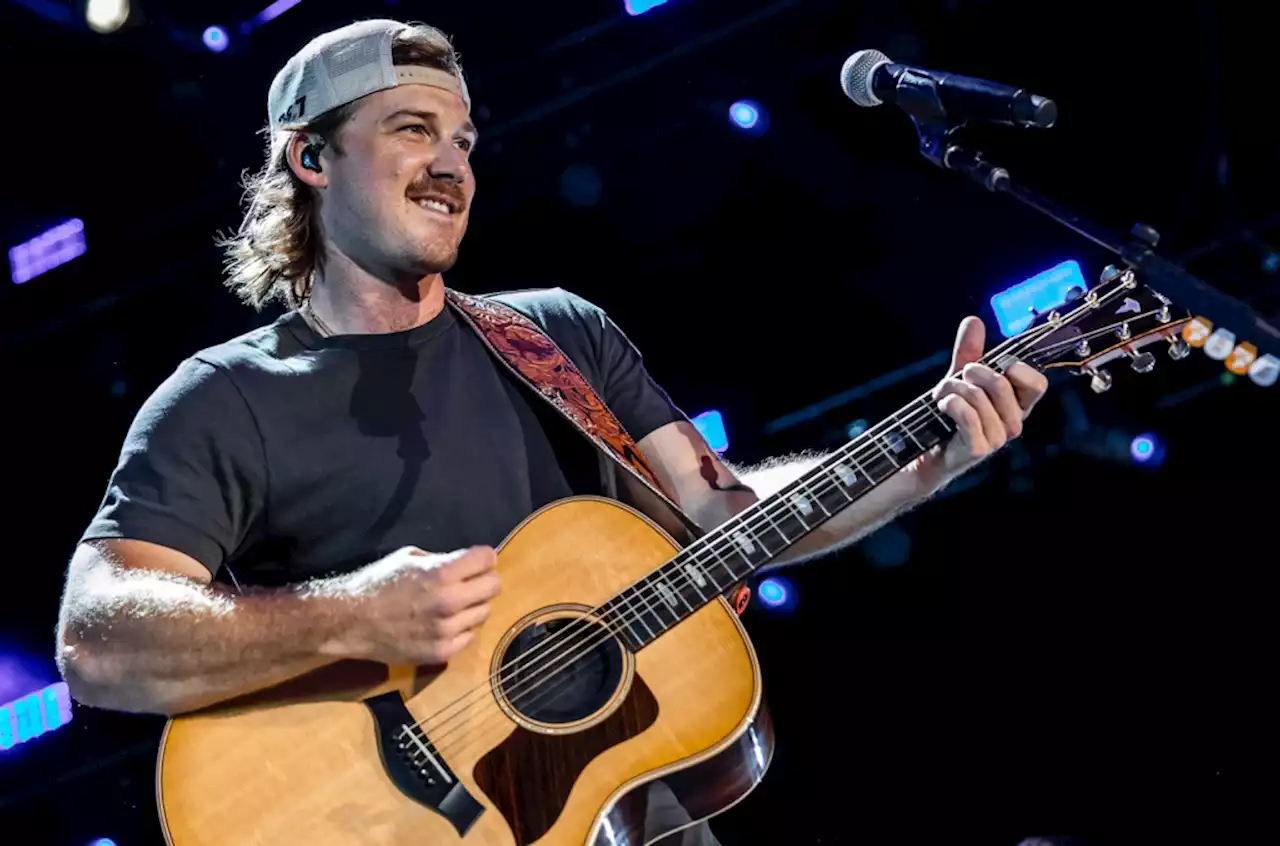

Morgan Wallen Leads Artist 100, Hot 100 & Billboard 200 Charts Simultaneously for Third Time.MorganWallen is No. 1 on the Artist100, Hot100 and Billboard200 charts simultaneously for a third time.

Morgan Wallen Leads Artist 100, Hot 100 & Billboard 200 Charts Simultaneously for Third Time.MorganWallen is No. 1 on the Artist100, Hot100 and Billboard200 charts simultaneously for a third time.

Read more »

AUD/USD remains sideways around 0.6700 ahead of RBA minutes and China’s GDPThe AUD/USD pair has continued its sideways auction in the early Asian session around 0.6700. The Aussie asset remained lackluster on Monday despite a

AUD/USD remains sideways around 0.6700 ahead of RBA minutes and China’s GDPThe AUD/USD pair has continued its sideways auction in the early Asian session around 0.6700. The Aussie asset remained lackluster on Monday despite a

Read more »

When are the RBA minutes and how might they affect AUD/USD?Early Tuesday morning in Asia, at 01:30 GMT, the Reserve Bank of Australia (RBA) will release the minutes of the latest monetary policy meeting held i

When are the RBA minutes and how might they affect AUD/USD?Early Tuesday morning in Asia, at 01:30 GMT, the Reserve Bank of Australia (RBA) will release the minutes of the latest monetary policy meeting held i

Read more »

AUD/USD whipsaws above 0.6700 as hawkish RBA Minutes join upbeat China Q1 GDPAUD/USD pares the first daily gains in three around 0.6710, after an initial jump to 0.6720, as strong China growth data joins RBA Minutes-led optimis

AUD/USD whipsaws above 0.6700 as hawkish RBA Minutes join upbeat China Q1 GDPAUD/USD pares the first daily gains in three around 0.6710, after an initial jump to 0.6720, as strong China growth data joins RBA Minutes-led optimis

Read more »