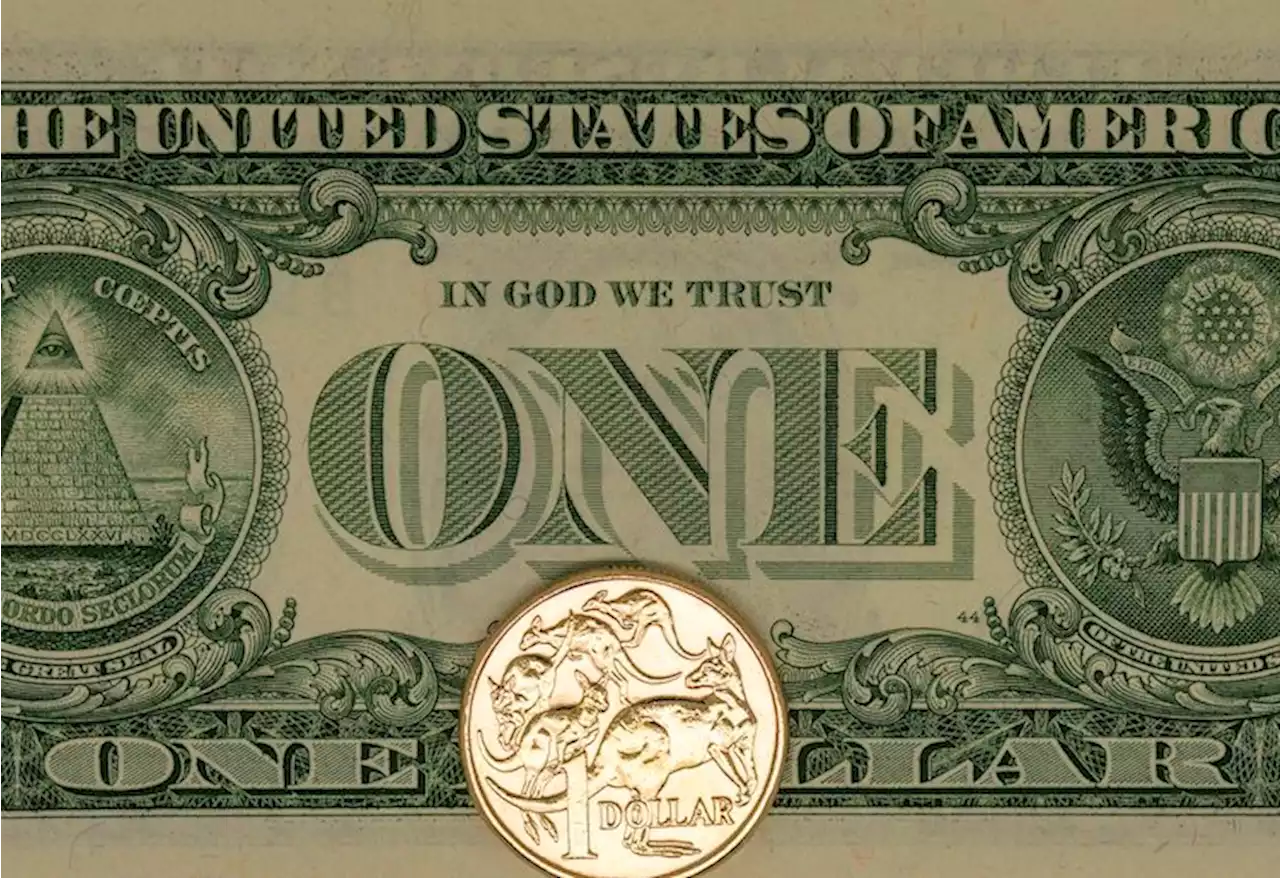

AUD/USD: Dwindling bets for a deeper pullback – UOB – by pabspiovano AUDUSD Currencies Majors Banks

In the view of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, the prospects for further decline in24-hour view: Last Thursday, AUD dropped to 0.6514 and then rebounded. On Friday, we highlighted, “Oversold conditions, coupled with early signs of slowing momentum, suggest low downside risk”, and we expected AUD to trade between 0.6530 and 0.6595. In NY trade, AUD dipped to 0.6541, rebounded strongly to 0.6610, and then pulled back to end the day at 0.6571 .

Next 1-3 weeks: We have held a negative AUD view for about 2 weeks now. In our most recent narrative from last Thursday , we highlighted that “while severely oversold, the weakness in AUD could extend to the year’s low near 0.6460.” On Friday, AUD rebounded to a high of 0.6610. Downward momentum is beginning to wane, and the chance of AUD dropping to 0.6460 is beginning to diminish. However, only a breach of 0.6620 would indicate that AUD is not weakening further.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AUD/USD posts modest gains around the 0.6570 mark, Australia/US inflation eyedThe AUD/USD pair kicks off the new week on a positive note and gains traction near 0.6575 during the Asian session on Monday. The uptick in the Aussie

AUD/USD posts modest gains around the 0.6570 mark, Australia/US inflation eyedThe AUD/USD pair kicks off the new week on a positive note and gains traction near 0.6575 during the Asian session on Monday. The uptick in the Aussie

Read more »

AUD/USD sticks to gains around 0.6580, bulls seem non-committed despite softer USDThe AUD/USD pair attracts some buying for the third successive day on Monday and trades around the 0.6580 region during the Asian session. This marks

AUD/USD sticks to gains around 0.6580, bulls seem non-committed despite softer USDThe AUD/USD pair attracts some buying for the third successive day on Monday and trades around the 0.6580 region during the Asian session. This marks

Read more »

AUD/USD prints unimpressive week-start below 0.6600, Australia/US inflation clues eyedAUD/USD kick-starts the inflation week with no major changes, making rounds to around 0.6570, while defending the last two days’ corrective bounce off

AUD/USD prints unimpressive week-start below 0.6600, Australia/US inflation clues eyedAUD/USD kick-starts the inflation week with no major changes, making rounds to around 0.6570, while defending the last two days’ corrective bounce off

Read more »

EUR/USD seems to have moved into a consolidative phase – UOBEconomist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group suggest EUR/USD could ace some consolidation in the near term. Key Quotes 24-

EUR/USD seems to have moved into a consolidative phase – UOBEconomist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group suggest EUR/USD could ace some consolidation in the near term. Key Quotes 24-

Read more »

AUD/USD sticks to gains around 0.6580, bulls seem non-committed despite softer USDThe AUD/USD pair attracts some buying for the third successive day on Monday and trades around the 0.6580 region during the Asian session. This marks

AUD/USD sticks to gains around 0.6580, bulls seem non-committed despite softer USDThe AUD/USD pair attracts some buying for the third successive day on Monday and trades around the 0.6580 region during the Asian session. This marks

Read more »