AUD/USD choppy but ultimately higher in upper 0.7100s as dollar slides post-mixed jobs report By Frank_Macro AUDUSD

g 50 pips in wake of a mixed US jobs report to the 0.7180s. The rally has stalled in this area given the presence of the 21-day moving average at 0.7190 and the Monday/Tuesday lows at 0.7185. On the day, that means AUD/USD is on course to gain around 0.3%, a fairly uninspired performance when compared to the gains some of its G10 peers are enjoying versus the US dollar in wake of the jobs data. And on the week, AUD/USD is still set to close about 1.2% lower.

FX strategists were perplexed at the dollar reaction to the latest jobs report. Yes, the headline monthly gain in non-farm payrolls came in at 199K, well below median forecasts for 400K. But that won’t matter too much to the Fed has acknowledged that the main problem holding the US labour market back from further job gains is a lack of labour supply, not demand. Meanwhile, the unemployment rate dropped under 4.

The jobs report thus meets the criteria that, so long as labour market progression remains reasonable, rate hikes will soon be warranted. In other words, the central banks tightening plans for 2022, as laid out at the December meeting and in its minutes, remain very much intact. This helped boost long-term US bond yields, with the 10-year yield hitting its highest since January 2020 at just under 1.80%. Typically, surging US yields would be dollar positive.

on Friday. Fed Chair Jerome Powell will also testify on Monday. That’s plenty of catalysts for dollar bulls to latch onto.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AUD/USD continues its two-day slump pierces 0.7160In the North America session, the AUD/USD slides for the second day of the week, courtesy by a hawkish Federal Reserve alongside a rise in US Treasury

AUD/USD continues its two-day slump pierces 0.7160In the North America session, the AUD/USD slides for the second day of the week, courtesy by a hawkish Federal Reserve alongside a rise in US Treasury

Read more »

USD/JPY struggles at 116.00 after mixed US NFP report amid higher US T-bond yieldsThe USD/JPY fails to gain traction after a mixed US Nonfarm Payrolls report, trading under the 116.00 threshold during the New York session. At the ti

USD/JPY struggles at 116.00 after mixed US NFP report amid higher US T-bond yieldsThe USD/JPY fails to gain traction after a mixed US Nonfarm Payrolls report, trading under the 116.00 threshold during the New York session. At the ti

Read more »

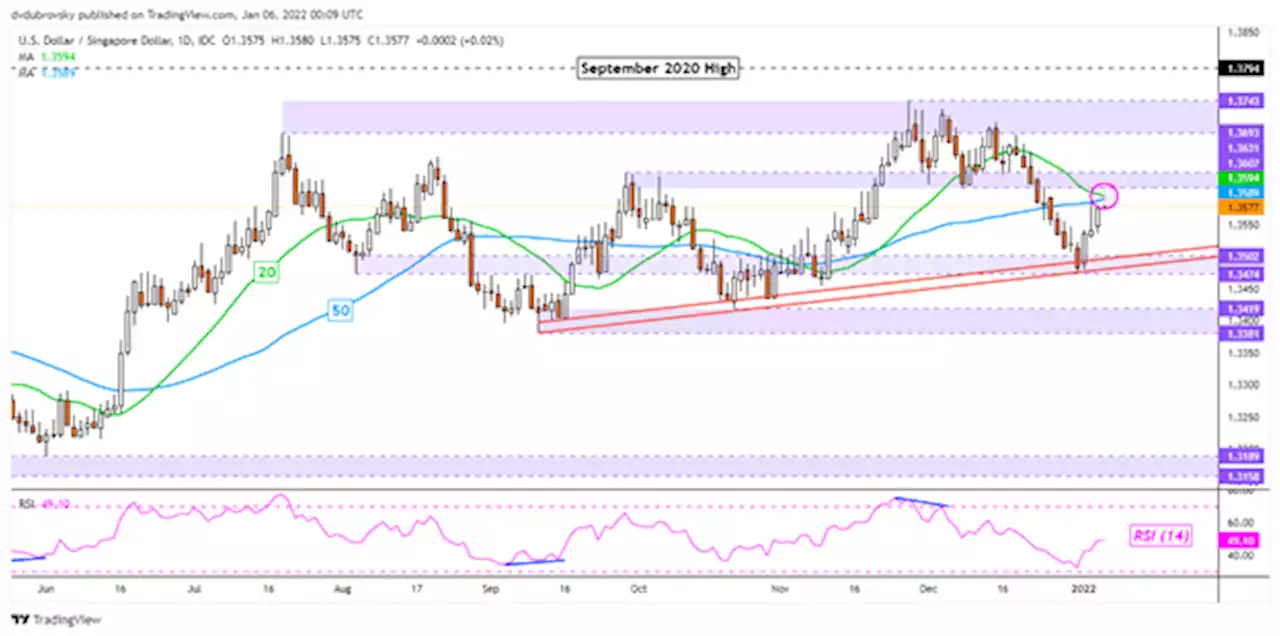

US Dollar Outlook: Back on the Offensive? USD/SGD, USD/THB, USD/IDR, USD/PHPThe US Dollar appears back on the offensive against ASEAN currencies, with USD/SGD, USD/THB, USD/IDR and USD/PHP facing their next key levels of resistance to start 2022.

US Dollar Outlook: Back on the Offensive? USD/SGD, USD/THB, USD/IDR, USD/PHPThe US Dollar appears back on the offensive against ASEAN currencies, with USD/SGD, USD/THB, USD/IDR and USD/PHP facing their next key levels of resistance to start 2022.

Read more »

AUD/USD slams into weekly support ahead of critical NFPsAround 0.7160, AUD/USD ended the day down some 0.80% on Thursday after falling from a high of 0.7222 to a low of 0.7145 in a technical move that has p

AUD/USD slams into weekly support ahead of critical NFPsAround 0.7160, AUD/USD ended the day down some 0.80% on Thursday after falling from a high of 0.7222 to a low of 0.7145 in a technical move that has p

Read more »

Gold Price Analysis: XAU/USD slides under $1800 as real yields surge post-hawkish Fed minutesTrading conditions in precious metal markets have been choppy in recent trade, though bearish momentum in wake of Wednesday’s hawkish Fed minutes seem

Gold Price Analysis: XAU/USD slides under $1800 as real yields surge post-hawkish Fed minutesTrading conditions in precious metal markets have been choppy in recent trade, though bearish momentum in wake of Wednesday’s hawkish Fed minutes seem

Read more »

GBP/USD hovering between 1.3500-1.3550 levels post-hakwish Fed minutes as traders await Friday’s US jobs reportGBP/USD continues to trade on the back foot on Thursday as the US session gets underway, despite a weaker than expected US December ISM Services PMI s

GBP/USD hovering between 1.3500-1.3550 levels post-hakwish Fed minutes as traders await Friday’s US jobs reportGBP/USD continues to trade on the back foot on Thursday as the US session gets underway, despite a weaker than expected US December ISM Services PMI s

Read more »