AskTheTaxWhiz: The Philippines Tax Whiz discusses the latest update for VAT zero-rated transactions.

services rendered for administrative operations such as human resources, legal, and accounting

Are health maintenance organization plans provided to employees of REEs considered ‘directly and exclusively used’ in the registered project? I already filed an application for VAT zero-rating, but the BIR still has not yet acted on my applications. Are my transactions already subject to zero-rated VAT?

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

BIR: Proposed 1% withholding tax on online sellers ‘not a new tax’“The proposal is a creditable withholding tax. So it’s not really a new tax. It’s just a mode of collecting,” BIR Commissioner Romeo Lumagui Jr. said. In its proposal, the BIR is eyeing to impose a creditable withholding tax of 1% on one-half of the gross remittances of online platform providers to their partner sellers or merchants.

BIR: Proposed 1% withholding tax on online sellers ‘not a new tax’“The proposal is a creditable withholding tax. So it’s not really a new tax. It’s just a mode of collecting,” BIR Commissioner Romeo Lumagui Jr. said. In its proposal, the BIR is eyeing to impose a creditable withholding tax of 1% on one-half of the gross remittances of online platform providers to their partner sellers or merchants.

Read more »

DOF: P2.5 billion tax collection if estate tax amnesty extended“We collected P4.8 billion until June 14, 2021 [during the first extension], collected P2.5 billion until March 2023. Since we were able to collect P2.5 billion during the last extension, Mr. Chair, we probably will be able to collect P2.5 billion which is the similar amount generated during the last extension,” Napao told lawmakers.

DOF: P2.5 billion tax collection if estate tax amnesty extended“We collected P4.8 billion until June 14, 2021 [during the first extension], collected P2.5 billion until March 2023. Since we were able to collect P2.5 billion during the last extension, Mr. Chair, we probably will be able to collect P2.5 billion which is the similar amount generated during the last extension,” Napao told lawmakers.

Read more »

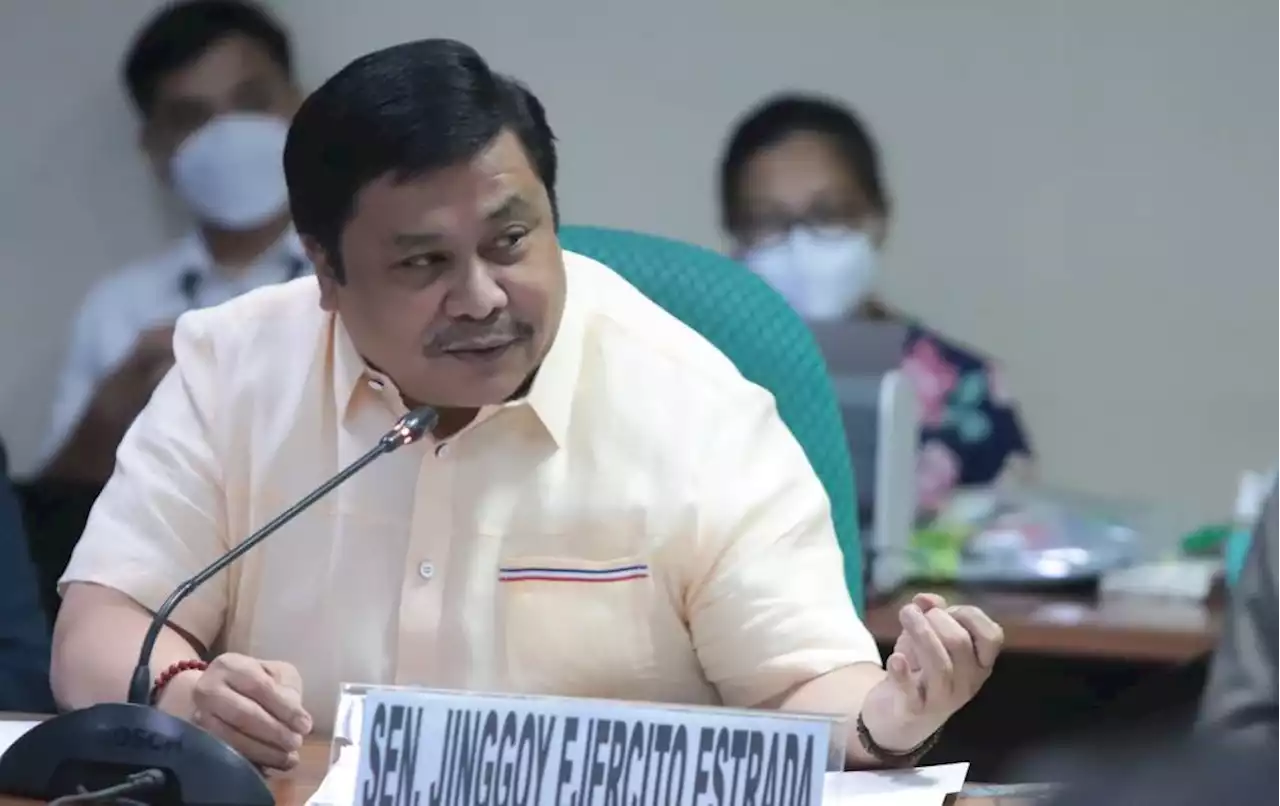

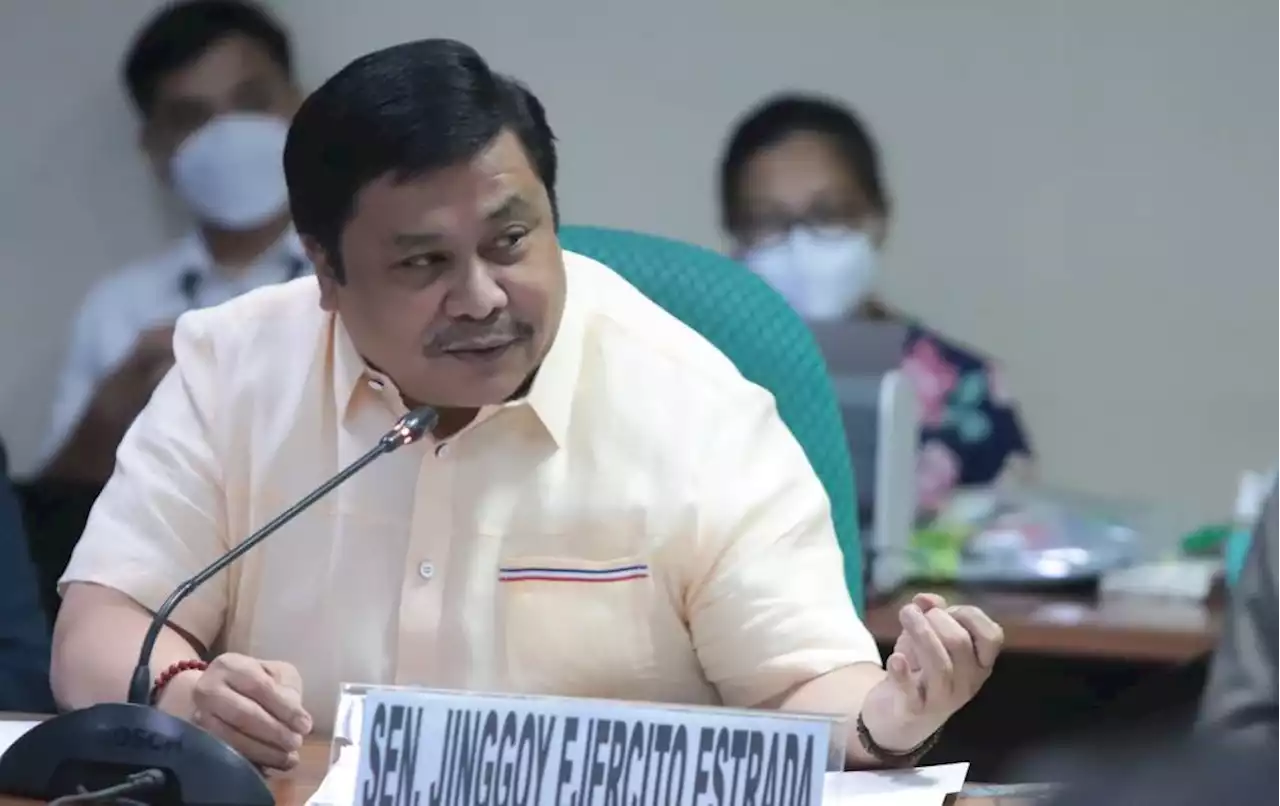

Estrada: VAT rebate to boost tourist traffic in PH Senator Jinggoy Ejercito Estrada has called on lawmakers to consider legislating a value-added tax (VAT) refund mechanism for foreign tourists to boost visitor arrivals in the Philippines. | ManilaBulletin

Estrada: VAT rebate to boost tourist traffic in PH Senator Jinggoy Ejercito Estrada has called on lawmakers to consider legislating a value-added tax (VAT) refund mechanism for foreign tourists to boost visitor arrivals in the Philippines. | ManilaBulletin

Read more »

NBI files criminal charges vs 31 officers, employees of firm ‘engaged in tax fraud, economic sabotage’The National Bureau of Investigation (NBI) on Friday, May 19, filed before the Department of Justice (DOJ) criminal complaints against 31 officers and employees of a company allegedly engaged in nationwide tax fraud and economic sabotage ManilaBulletin

NBI files criminal charges vs 31 officers, employees of firm ‘engaged in tax fraud, economic sabotage’The National Bureau of Investigation (NBI) on Friday, May 19, filed before the Department of Justice (DOJ) criminal complaints against 31 officers and employees of a company allegedly engaged in nationwide tax fraud and economic sabotage ManilaBulletin

Read more »

BIR blames illicit cigarettes for lower sin tax collectionThe Bureau of Internal Revenue (BIR), the government’s main tax agency, blamed the rampant illicit cigarette trade in the country for the lower-than-expected collection of sin taxes.

BIR blames illicit cigarettes for lower sin tax collectionThe Bureau of Internal Revenue (BIR), the government’s main tax agency, blamed the rampant illicit cigarette trade in the country for the lower-than-expected collection of sin taxes.

Read more »

Estrada: VAT rebate to boost tourist traffic in PH Senator Jinggoy Ejercito Estrada has called on lawmakers to consider legislating a value-added tax (VAT) refund mechanism for foreign tourists to boost visitor arrivals in the Philippines. | ManilaBulletin

Estrada: VAT rebate to boost tourist traffic in PH Senator Jinggoy Ejercito Estrada has called on lawmakers to consider legislating a value-added tax (VAT) refund mechanism for foreign tourists to boost visitor arrivals in the Philippines. | ManilaBulletin

Read more »

![[Ask The Tax Whiz] Are there updates for VAT zero-rated transactions?](https://i.headtopics.com/images/2023/5/20/rapplerdotcom/ask-the-tax-whiz-are-there-updates-for-vat-zero-ra-ask-the-tax-whiz-are-there-updates-for-vat-zero-ra-1659824049524973569.webp)