OPINION: After adjusting for the severe drop in the purchasing power of a dollar, the real (or inflation-adjusted) value of aggregate household wealth fell by a record $8.7 trillion, according to our analysis of the data released by the Federal Reserve.

U.S. households’ real wealth plunged at a record 20.9% annual rate to $143 trillion in the second quarter of the year, with modest gains in home values offset by high inflation and a big selloff in the stock market SPX, +1.06% DJIA, +0.71% COMP, +1.27%, according to data released Friday by the Federal Reserve and analyzed by MarketWatch.

While the Fed doesn’t directly target stock prices, policy makers know that higher rates generally hurt stocks and that the loss of wealth on Wall Street is one of the main ways the Fed can affect the economy on Main Street. Consumer spending could be reduced by hundreds of billions of dollars over the next year via this wealth effect.

Wealth is defined as the value of all assets owned by U.S. residents minus the value of their liabilities . Unfortunately, the Fed reports the data in nominal terms and does not adjust for inflation, in part because the Fed’s financial accounts release follows global reporting standards. Unfortunate because reporting the data in nominal terms distorts the reality of inflation’s impact on family wealth.

In real terms, household holdings of corporate equities and mutual funds fell by a record $7.4 trillion to $35.3 trillion in the second quarter, the Fed reported. At the same time, the real value of real estate rose by $771 billion to $41.2 trillion as house prices continued to rise faster than overall inflation.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Patrick Mahomes net worth: How the Chiefs QB spends his moneyPatrick Mahomes signed the richest deal in NFL history — here's how the Chiefs QB spends his money

Read more »

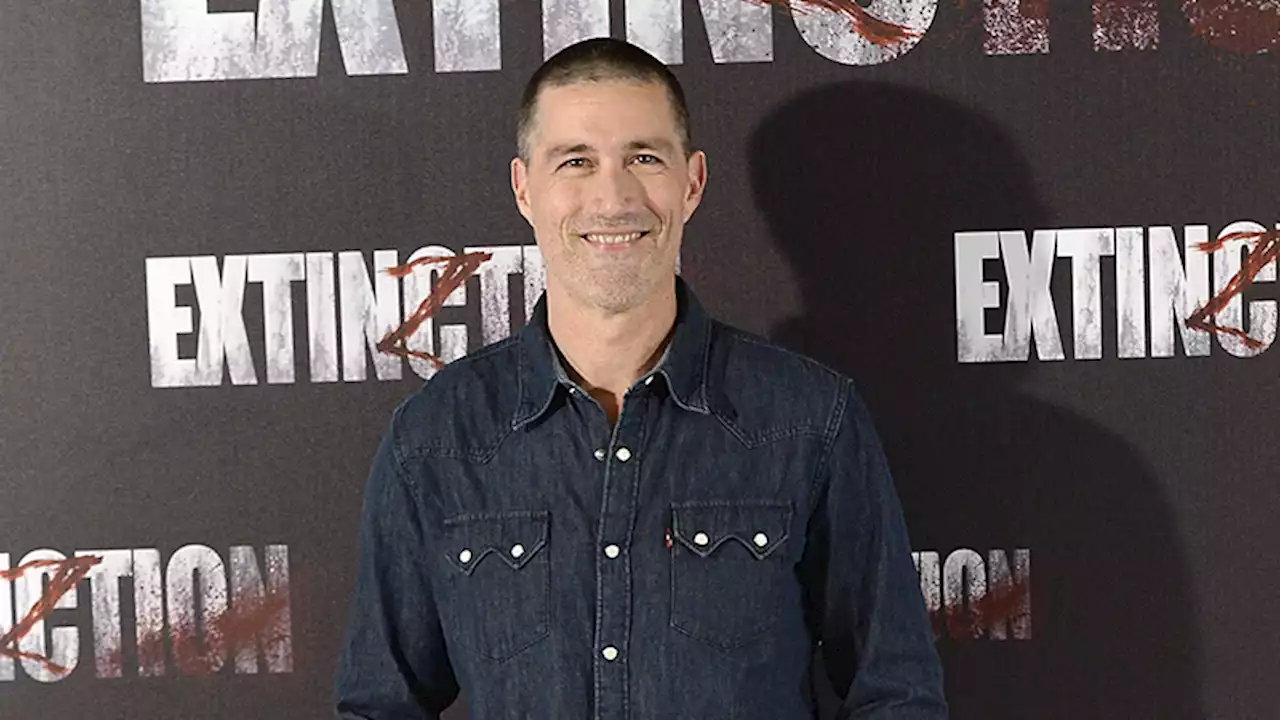

Why Matthew Fox Returned to Acting With Last Light - ComingSoon.netDuring an interview with ComingSoon ahead of the release of Last Light, Matthew Fox revealed what it was about the series that made him return to acting.

Why Matthew Fox Returned to Acting With Last Light - ComingSoon.netDuring an interview with ComingSoon ahead of the release of Last Light, Matthew Fox revealed what it was about the series that made him return to acting.

Read more »

Pursuing net zero could grow carbon-offset market to $35B by 2030: MSThey said yearly CO2 removal would need to double by 2030 for the world to reach net zero in 2050. Presented by SchneiderElec

Read more »

Why Rooftop Solar Power Investments Are Worth It, & Why California Solar Net Metering Might Not Be Fair — Competing Op-EdsWe have some of the most informed readers in the world, but that doesn't mean they agree on everything. In fact, sometimes they have feverish yet well informed debates that genuinely use logic (rather than

Why Rooftop Solar Power Investments Are Worth It, & Why California Solar Net Metering Might Not Be Fair — Competing Op-EdsWe have some of the most informed readers in the world, but that doesn't mean they agree on everything. In fact, sometimes they have feverish yet well informed debates that genuinely use logic (rather than

Read more »

Americans are feeling poorer for good reason: Household wealth was shredded by inflation and Fed tighteningOuch: Household wealth fell by $6.1 trillion from March 31 to June 30 - but adjusted for inflation, the financial hit was more like a record $8.7 trillion, columnist Rex Nutting explains. OPINION

Americans are feeling poorer for good reason: Household wealth was shredded by inflation and Fed tighteningOuch: Household wealth fell by $6.1 trillion from March 31 to June 30 - but adjusted for inflation, the financial hit was more like a record $8.7 trillion, columnist Rex Nutting explains. OPINION

Read more »